Taxes serve as the primary source of revenue for governments at various levels, including local, state, and federal. They fund essential public services and programs that benefit society as a whole. Here are some common uses of tax revenue:

Infrastructure: Taxes are used to build and maintain infrastructure such as roads, bridges, public transportation systems, and utilities like water and sewage systems.

Education: Tax revenue supports public education at all levels, from primary schools to universities, including funding for teachers’ salaries, school facilities, and educational resources.

Healthcare: Taxes contribute to funding public healthcare programs, including Medicare and Medicaid in the United States, as well as public health initiatives, research, and healthcare infrastructure.

Defense and Security: Taxes finance national defense and security efforts, including military operations, border security, law enforcement agencies, and emergency services.

Social Services: Tax revenue is used to support social welfare programs that provide assistance to vulnerable populations, such as food assistance, housing programs, unemployment benefits, and disability services.

Government Operations: Taxes cover the costs of running government agencies, including salaries for public servants, administrative expenses, and the implementation of laws and regulations.

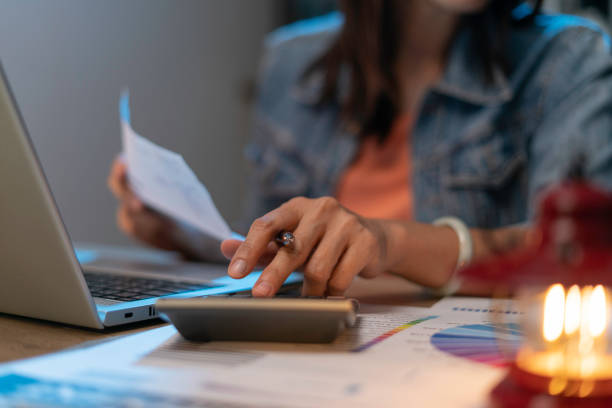

HOW TO FILE YOUR OWN TAXES

As for filing taxes, the process varies depending on your country’s tax system. In the United States, for example, individuals typically file their taxes annually with the Internal Revenue Service (IRS). Here’s a general overview of how tax filing works in the U.S.:

Gather Necessary Documents: Collect all relevant financial documents, including W-2 forms (for employment income), 1099 forms (for other income), receipts for deductible expenses, and any other documentation related to your finances.

Choose a Filing Method: You can file your taxes electronically using tax preparation software or through the IRS Free File program, or you can file by mail using paper forms.

Complete Your Tax Return: Fill out the appropriate tax forms, reporting your income, deductions, credits, and other relevant information. Double-check your entries for accuracy and ensure that you’ve claimed all available deductions and credits.

Submit Your Return: If filing electronically, follow the instructions provided by the tax preparation software or IRS Free File program to submit your return electronically. If filing by mail, mail your completed forms to the address specified by the IRS.

Pay Any Taxes Due: If you owe taxes, you’ll need to pay the amount owed by the tax filing deadline, typically April 15th in the U.S. If you’re due a refund, you can choose to have it directly deposited into your bank account or receive a paper check in the mail.

Keep Records: Retain copies of your tax return and supporting documentation for your records. It’s a good idea to keep these documents for several years in case of any future inquiries or audits.

It’s important to note that tax filing requirements and procedures may vary by country, so it’s advisable to consult with a tax professional or refer to official government resources for guidance tailored to your specific situation.